How it works

For you

- Consolidated debtor reports

- Client debtor scorecards

- Training for your team

- Free marketing materials

- Co-hosted webinars

- 10% – 25% revenue share

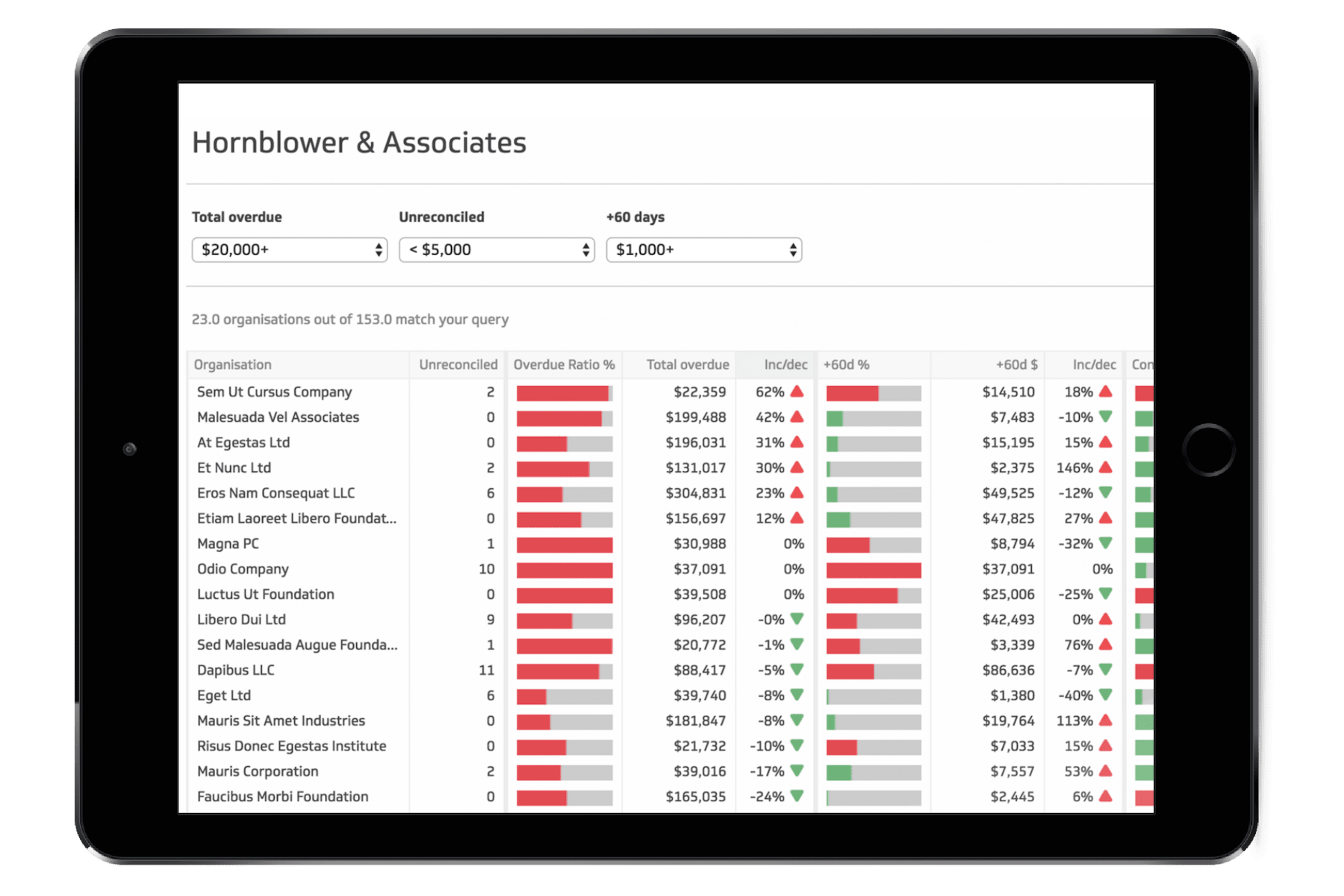

Powerful reporting tools

Radar produces a consolidated report of your clients’ debtor situations, leveraging your business advisory skill set with the click of a button.

- Identify the worst and best performers

- Get actionable insight without logging into each client’s ledger

- Give access to anyone in your team

Radar produces a consolidated report of your clients’ debtor situations, leveraging your business advisory skill set with the click of a button.

- Identify the worst and best performers

- Get actionable insight without logging into each client’s ledger

- Give access to anyone in your team

Working with us

Our team is available to answer your questions and train your team via email, live chat and phone.

We bill you once a month for the volume you put through our platform and you charge your clients as part of their annual or monthly accounting services. Qualifying partners can earn a revenue share of up to 20%.

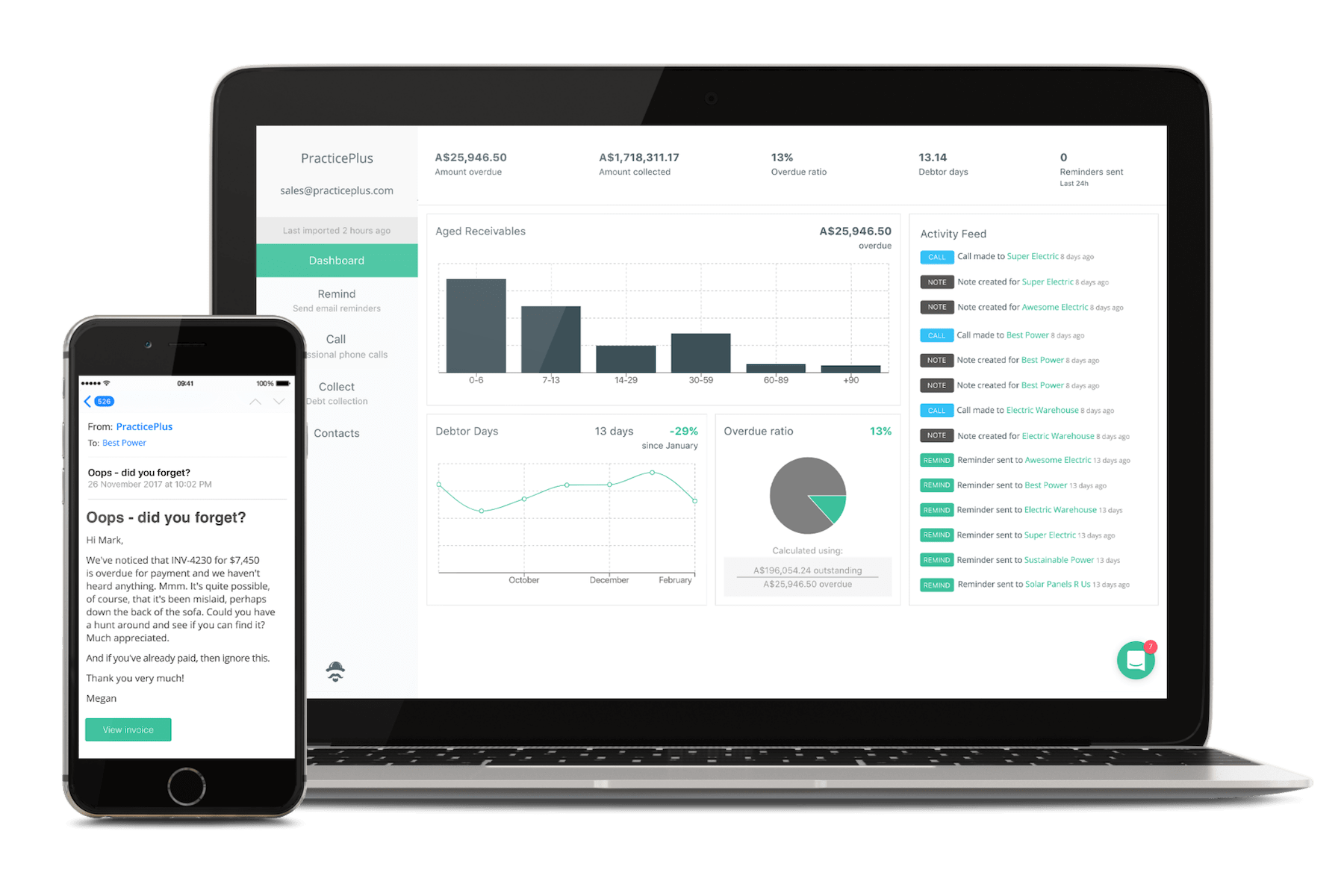

For your clients

- Automated email reminders

- Follow up phone calls

- Debt collection & legal services

- Customised strategy

- Training & support

- Custom reports & alerts

Flexible payment options

For clients who need an ongoing debtor management solution

We help you create a customised service plan for each client, including reminders, calls and debt collection – perfectly suited to their needs.

For clients who only need occasional help with receivables

No monthly fee, pay only for the reminders, calls and collection services used each month.

Setup & consulting services

A complimentary service for partners. Normally $299.

We complete the setup and training for your clients via phone or virtual meeting, including:

- Basic receivables analysis

- Customisation of reminder content and timing

- Recommendations for rules and escalation

- User training

- Check-in / account review after one month

You’re welcome to host these sessions or join us on the call. You decide whether you charge your client for this service or not.

RRP $1,495. Billed to you or your client.

The key to solving debtor pain and improving cashflow long term is creating a robust, rules-based receivables strategy. A CreditorWatch Collect receivables specialist will review and provide recommendations to improve the following processes:

- Overdue invoice follow up strategy (timing, content, emails and calls)

- Credit application and approval process

- Customer onboarding process (to ensure all the necessary information is captured)

- Payment methods appropriate and easy to use

- Policies for stop credit, payment arrangements and debt collection are setup and enforced

- Systems & software for quoting, invoicing, job tracking are well integrated and data is correct e.g phone numbers, emails

How to get started

- Register to become a CreditorWatch Collect partner (it’s free)

- Connect your clients to Radar

- We review your Radar reports together & answer your questions

- We create a customised rollout plan to solve debtor pain for your clients