It’s no secret that long payment terms cause serious headaches for business owners, and in recent times small businesses need cash flow support more than ever.

A recent report by Xero found that over half of SMEs in Australia and New Zealand cited getting paid on time and cash flow difficulties as their top financial challenges. Making it hard to pay bills, hire staff, buy inventory and grow stress-free.

Businesses that are low on cash have to either take out a loan or simply “make do” with the lack of cash because lending can seem risky and hard to do.

Invoice financing can be a faster, more flexible option. Thanks to innovative providers like FundTap, invoice financing is becoming a great way for businesses to overcome a drop in cash flow and get access to funding that’s fast, simple and transparent.

Five advantages of invoice financing:

1. Improved cash-flow

The main reason why so many businesses choose invoice financing is the immediate improvement it can make to cash flow. Being able to release the funds tied up in invoices so quickly puts businesses in a much better position.

2. Feel better about big projects

Small businesses carry a lot of costs when agreeing to a big job and payment is often slow when there’s a large business involved.

While trade between large businesses and SMEs is a critical part of the economy, it is estimated that the value of late payments to small businesses is $115 billion each year, based on Xero figures (and that’s just in Australia).

Invoice financing allows businesses to take on larger and more profitable contracts without getting stretched too thin as they are able to get immediate access to the cash from the invoice, instead of waiting the normal 30 to 60+ days for payment.

3. You’re in control

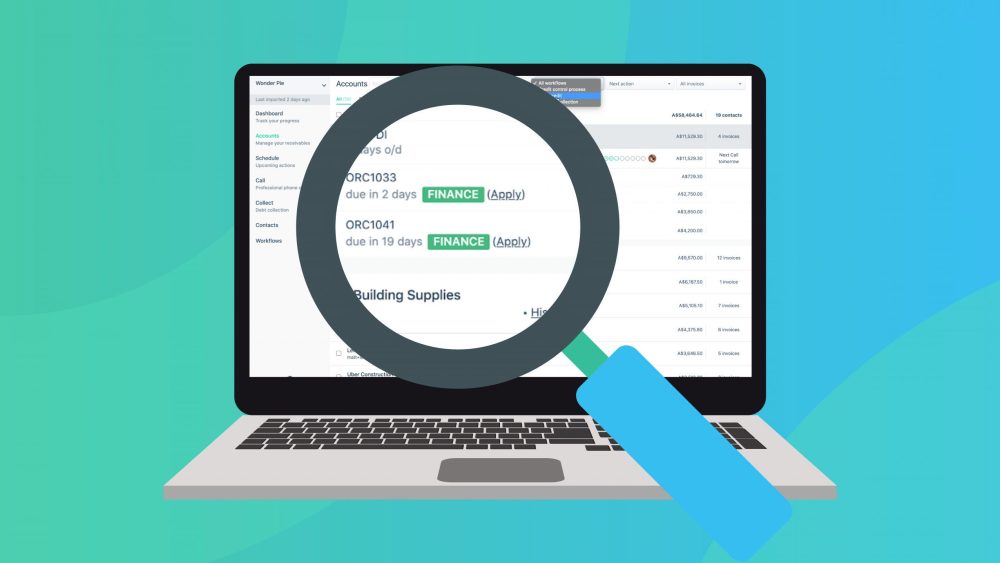

Businesses can choose what invoices they want to be financed. FundTap also shows the amount businesses will receive and the associated fees before confirmation so all the information is there to make a decision.

4. It’s fast

Invoice financing is quick and easy. Business owners no longer have to spend time collecting information. It’s as quick as logging in and selecting the invoices. Business owners can have access to funds within hours so they can spend their valuable time growing and running their business.

5. No paperwork

Business owners don’t need to leave their office, store or workshop to apply for invoice finance. Businesses can connect to invoice financing providers via online accounting software, flag the unpaid invoices that they’d like to finance, and apply on the spot. There’s no paperwork to do.

Any questions?

Ask them at our upcoming webinar where we’re joined by Matt Peacey of FundTap. The webinar covers the ins and outs of invoice financing and the best strategies to make invoice financing work for your business.

Comments are closed.